GST refunds and the process can be skeptical to some whereas, if you have the right information by your hand, then things become simple. There are a few notches that one needs to understand before taking on the process. As the application beholder, one needs to learn the quick things about GST Refunds, time limits, application procedure, and other mandatory steps to complete the process. Read on to learn more about GST Refunds!

Timeline for claiming GST Refund:

A GST refund application to be filed within two years from the relevant date in accordance with section 54 read with rule 89 of the CGST Rules.

If a refund application is not at the satisfaction of the officer and certain deficiencies are noted by the officer, he shall issue a deficiency memo and may ask to file a fresh application. Such a scenario becomes very dangerous when the application for the refund was filed within the last week of the due date. As in that scenario, the rectification of a deficiency memo would result in filing the fresh application after the due date. Then, there is always a high probability that a refund claim could be treated as time-barred by the department. Thus, the applicant must plan the refund claim in advance.

Details to be provided while applying for refund:

Refund claim shall be filed in accordance with the requirement mentioned in the master Circular No. 125 dated November 18, 2019, and also Circular No 135 dated March 31, 2020. The major points to be taken care are as under:

- The claim to be filed in the prescribed formats and to be filled completely

- In case of refund of accumulated Input Tax Credit (ITC), only invoices reflecting in GSTR-2A to be considered as eligible ITC for refund claim.

- HSN/SAC code of suppliers to be mentioned correctly in Annexure B. No requirement to mention HSN/SAC code in respect of inward supplies where the supplier is not mandated to mention the same on invoice.

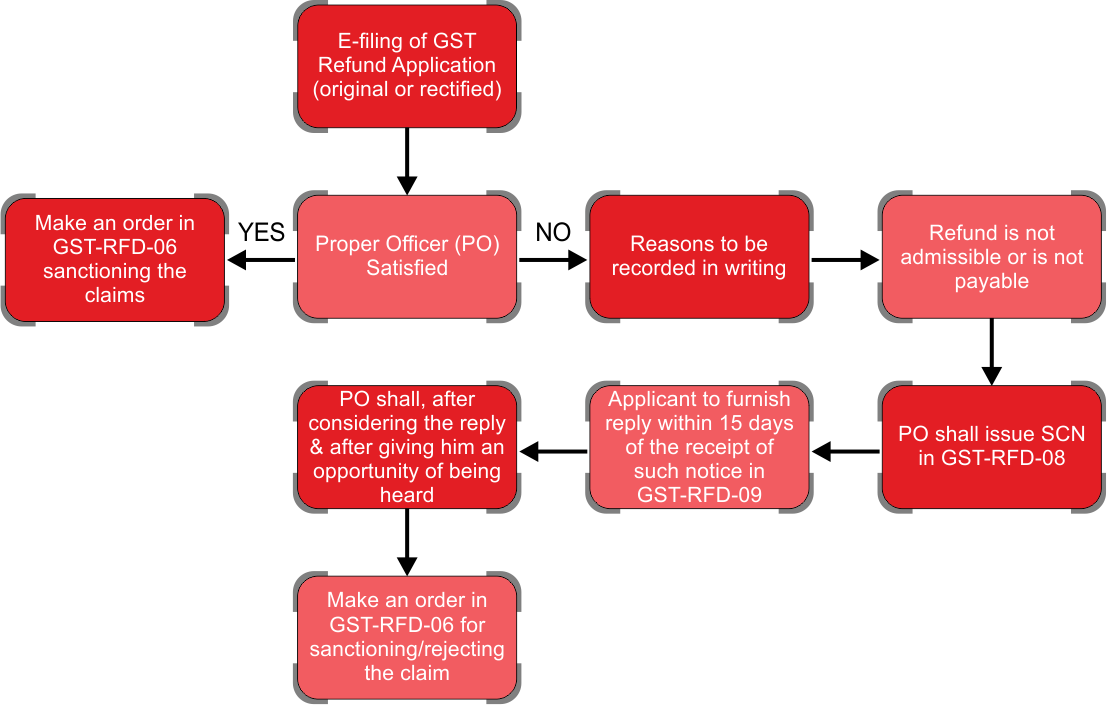

Statutory procedure of processing the GST refund claim once the refund application is filed:

Action from applicant side:

As the processing of refund application is time-bound, checking the status and timely replying to the queries of the GST department is very important.

- Keep a watch on the registered e-mail id and keep on checking the status of the application on GST portal

- If any deficiency memo in RFD-03 is received, please take immediate action to check and rectify the same by filing a fresh Refund Application

- If any show-cause notice in form RFD-08 is issued, please check and e-file the reply along with the supporting documents within 15 days. If the officer has given an opportunity for Personal Hearing (PH), please take the benefit of the same to explain your standpoint

- If no change in status on GST portal or no communication received on registered e-mail id, then it is advisable that the applicant intimate the same to the officer by using the tab “Intimation on account of refund not received” which is specifically provided on the GST portal under “Refund” tab

Virtual Hearing on GST Refund – Welcome move by GST Department

- The officer issues a Show Cause Notice (SCN) if the eligibility of the claim is unsatisfactory.

- A written reply is required from the Applicant and a Person Hearing (PH) is offered.

- Due to the COVID-19 situation, Personal Hearing through electronic mode by the GST authorities.

Below are the steps involved:

- Given an opportunity, if the applicant wishes to opt for an electronic Personal Hearing, the same should be communicated in writing to the Department and mobile number to be provided if it is to be held on Whatsapp.

- The Department provides a PH schedule and a link to join the same.

- It is advisable to log in 5-10 minutes ahead of schedule and confirm your presence by stating your name and designation.

- Over the PH, the officer explains his/her question, and Applicant has to explain his/her stance for questions asked in SCN.

- The replies are to be submitted in writing on the GST portal.

- Post-hearing, a PH memo (record of the PH) is sent via email to the Applicant.

- The Applicant has to validate the PH memo and send an email confirmation.

The virtual hearing will help to speed up the process of refund and makes it more convenient as opposed to visiting the department office.

File your GST Refund Claims in prescribed format with complete details/documents and also file it well in advance, keep track of the status and take necessary timely actions to help to have your refund processed smoothly.