For foreign businesses operating in India, repatriating the hard-earned profits and surplus funds can be taxing because of the many interconnected local and international laws and regulations that must be...

Purchasing a house is one of the biggest investments that a person makes in his/her lifetime. Since it involves a huge sum of money, most people require financing to buy...

What is OIDAR? Online Information Database Access and Retrieval services, aka “OIDAR” is a category of services provided through the medium of internet and received by the recipient online without...

What is Record-to-Report (R2R)? Record-to-Report (R2R) is the backbone of any company’s or business’s Financial Management. It is the management of Finance and Accounting process that involves collecting, processing, and...

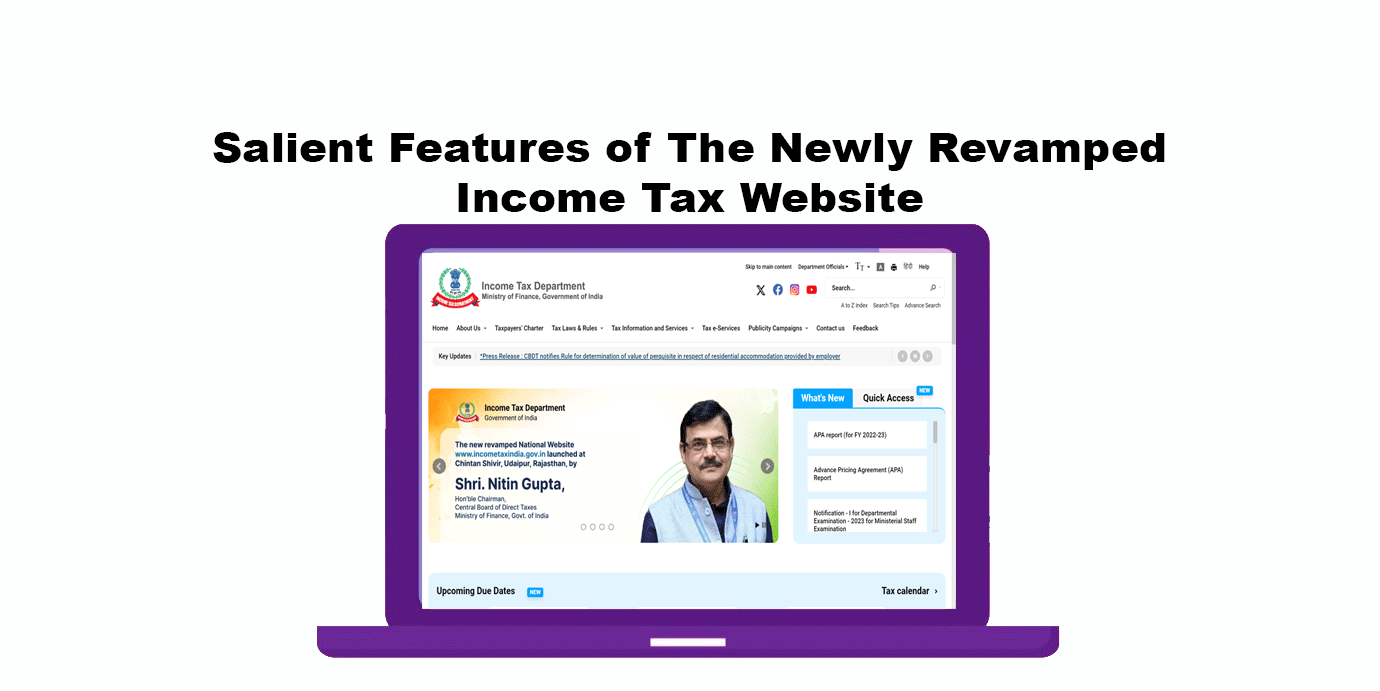

As a part of Government’s initiative, to build confidence & bring transparency in the working of the Income Tax Department, Central Board of Direct Taxes (CBDT) has launched all new,...

In today's interconnected and fast-paced business world, professional etiquette plays a pivotal role in building successful relationships and in advancing your career. Practicing effective etiquette demonstrates respect, cultivates positive interaction,...

The Indian Capital Gains Tax structure is overly complicated with respect to the various classes of assets, tax rates, period of holdings and indexation benefits. Over the years, there have...

What is Cryptocurrency? Cryptocurrencies are digital tokens. They are a type of digital currency that allows people to make payments directly to each other through an online system. Most cryptocurrencies...

With an intention to curb fake invoice transactions, the central government vide notification no. 94/2020 – Central Tax, dated December 22, 2020, has added a new rule 86B in the...

Credit cards are an essential tool in today's financial world. They offer convenience, security, and rewards for making purchases. However, like any financial tool, credit cards have their pros and...