In order to make informed decisions in any organization, it is important to have access to the data at the right time. Data is the new gold and different types of MIS reports are what helps companies to understand and make beneficial use of them. Data reports and their analysis is a necessity for every organization. They are also referred to as Management Income Statement, and are the natural P&L or the departmental income statement of an organization.

What Is the Need of an MIS Report?

An MIS report is a system that dispenses important information to the management of an organization. Its aim is to inform different aspects of the business, and to help in making better-informed decisions. Such reports furnish the management with insights on company’s progress, empowers the decision-makers to find the right path to increase operating efficiency and enables them to make pertinent decisions to remain competitive.

Significance of Timely Analysis of an MIS Report

This report basically shows the worth of a business for a specific time period by disclosing the financial and operational information.

A successful business organization implements managerial reports not only to track department’s key performance indicators (KPIs) but also to help guide the managers to making accurate, data-driven decisions. These decisions can include various aspects from cutting costs to escalating revenues.

The various MIS reports maximize the time usage by constant evaluation. It highlights the variance (if any) between actual and planned/budgeted performance at regular intervals and suggests timely and corrective measures appropriately

Management reports are of an absolute importance for organizational strategy building, and every good leader knows it! They help them control and direct their businesses and acts as a strong decision-making tool.

How Organizations can make judicious use of MIS Reports?

- Identifying which products have the highest profit margin and which have the lowest.

- Examining and evaluating the cost-efficiency of each department of the company, in light of what percentage of the company’s financial resources each department consumes.

- Preparing internal reports for executive leadership and supporting their decision making.

- Creating, updating, and maintaining financial modelsand detailed forecasts of the company’s future operations.

- Comparing historical results against budgets and forecasts, and performing variance analysis to explain differences in performance and make improvements going forward.

- Considering opportunities for the company to expand or grow. Mapping out growth plans, including capital expenditures and investments. Generating three- to five-year financial forecasts.

MIS Reports vs Annual Financial Reports (Financials)

Most people in business are familiar with financial reports, which your company is required to keep for external accounting purposes. These reports are generally put out “after the fact” and follow a very clear and established set of guidelines known as Generally Accepted Accounting Principles (GAAP).

While such reports are useful for legal purposes, they’re not ideal for decision-making. They give you a bird’ eye view of your business operations, but without actionable insights or granular data that are useful for making strategic choices.

| MIS Reports | Financial Reports |

| Helps Track business performance and make future predictions on the basis of current scenario. | Focuses only on the business’s past performance. |

| These reports provide insights and constant growth opportunities identifying key areas to focus on. | These are mandatory for legal purposes and prepared with no such intentions. |

| They are prepared to be presented in the internal meetings. | They are prepared to be presented to the external stakeholders. |

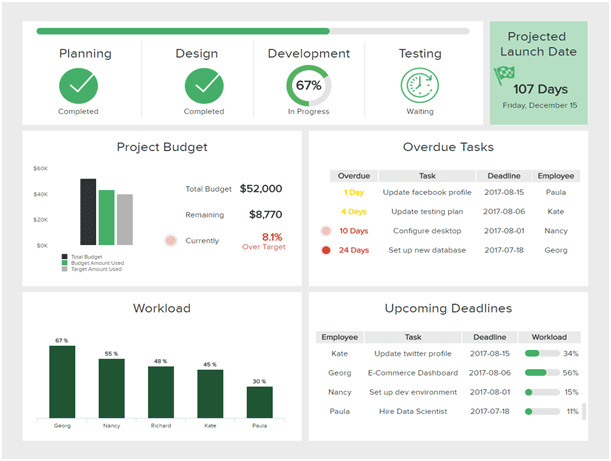

A Dashboard representation of an MIS Report Analysis for an IT Business:

The fundamental purpose of MIS reports and its analysis is to determine the performance by comparing the target achieved with the target planned and understanding what’s working and what’s pulling them down. With those, businesses can adopt the best practices that would give better results.