What is Record-to-Report (R2R)? Record-to-Report (R2R) is the backbone of any company’s or business’s Financial Management. It is the management of Finance and Accounting process that involves collecting, processing, and presenting financial information in the form of documents that are used by the management to perform analysis and review. It ensures accuracy, compliance, and provides...

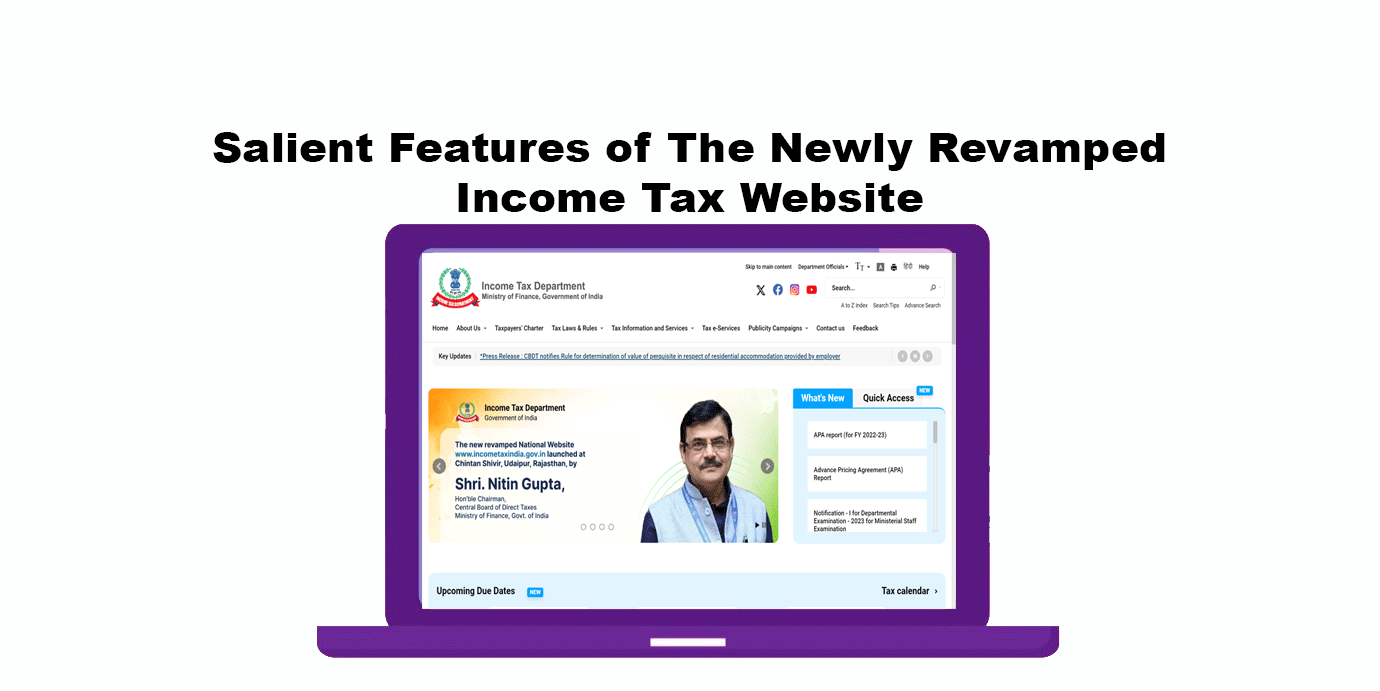

As a part of Government’s initiative, to build confidence & bring transparency in the working of the Income Tax Department, Central Board of Direct Taxes (CBDT) has launched all new, revamped, and updated websites; viz. www.incometaxindia.gov.in. The Chairman of the Central Board of Direct Taxes (CBDT), Nitin Gupta launched the revamped website in an event...

In today's interconnected and fast-paced business world, professional etiquette plays a pivotal role in building successful relationships and in advancing your career. Practicing effective etiquette demonstrates respect, cultivates positive interaction, and reflects your commitment to professionalism. How to Demonstrate Adequate Professional Etiquette? Foundation of an Effective Communication is by Showing Respect Respect forms the cornerstone...

The Indian Capital Gains Tax structure is overly complicated with respect to the various classes of assets, tax rates, period of holdings and indexation benefits. Over the years, there have been timely amendments in the capital gains framework and has thus evolved and risen to a complex tax code within its framework. As an effect,...

What is Cryptocurrency? Cryptocurrencies are digital tokens. They are a type of digital currency that allows people to make payments directly to each other through an online system. Most cryptocurrencies exist on decentralized networks using block-chain technology. This decentralized structure allows them to exist outside the control of government and central authorities. In Finance Act...

With an intention to curb fake invoice transactions, the central government vide notification no. 94/2020 – Central Tax, dated December 22, 2020, has added a new rule 86B in the CGST Rules 2017.Accordingly, there is a restriction in the use of ITC (Input Tax Credit) which is available in the electronic credit ledger while making...

Credit cards are an essential tool in today's financial world. They offer convenience, security, and rewards for making purchases. However, like any financial tool, credit cards have their pros and cons, and it's essential to use them effectively to avoid financial difficulties. Pros of Using Credit Cards Convenience: One of the primary benefits of credit...

A liaison office is a vital communication bridge between a foreign company’s head office and the Indian market. It facilitates market research, information dissemination, and promotion of the parent company’s products without engaging into revenue-generating activities in India. Let's deep dive into the essential steps and compliance requirements to establish a liaison office in India....

The overall plan for an audit serves as a roadmap by providing direction and guidance for the audit process. With the audit plan as a base, an auditor conducts a comprehensive and efficient examination of the entity’s financial statements. Auditor is responsible to provide true and fair view on the financial statements as a whole...

The 50th GST council meeting marked a significant milestone in the journey of Goods and Services Tax (GST). Led by Union Finance & Corporate Affairs Minister Nirmala Sitharaman, the council discussed and recommended changes in GST tax rates, measures to facilitate trade, and streamline compliance processes. Find below the key highlights from the meeting: Changes in...